Think No One’s Buying Homes Right Now? Think Again.

Think No One’s Buying Homes Right Now? Think Again. If you’ve seen headlines saying home sales are down compared to last year, you might be thinking – is it even a good time to sell? Here’s the thing. Sure, the pace of the market has cooled compared to the frenzy we saw just a few years ago, but th

Why Homeownership Is Going To Be Worth It

Why Homeownership Is Going To Be Worth It Life can feel a bit unpredictable these days. What’s happening with inflation? The economy? The housing market? But in the middle of all that uncertainty, there’s one thing a lot of people still crave – a place to call their own. Because when everything else

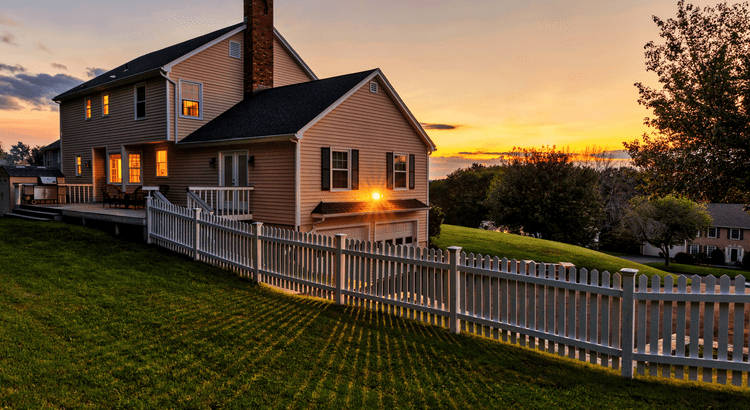

Is Inventory Getting Back To Normal?

Is Inventory Getting Back To Normal? After years of it feeling almost impossible to find a home you want to buy, things are changing for the better. Nationally, inventory is growing, and that gives you more options for your move. But here’s what you need to know. That level of growth is going to var

Recent Posts